Discover Vietnam’s Untapped FDI Potential: Seize The Opportunity Now!

According to experts, Vietnam should take advantage of the opportunity to increase foreign direct investment (FDI) from the domestic Asian region, as investment from Europe and the US remains hesitant due to economic instability.

While the new opportunities are evident, Vietnam still faces many challenges in competing with other destinations.

Investors Hesitant In The Face Of Global Recession

Total FDI capital (including newly registered, adjusted, and capital contributions and share purchases) in Vietnam reached nearly USD 3.1 billion at the beginning of this year, a decrease of 38% compared to the same period last year. Along with this, the actual disbursement of investment also decreased by 4.9%, reaching approximately USD 2.55 billion. Experts believe that this development can be predicted due to the continued economic instability globally and investors continuing to be cautious about pouring money into the market.

The difficulty in attracting FDI will put pressure on Vietnam’s growth targets. Multinational companies in the region and globally operating in Vietnam contribute over 80% of total export turnover and more than 25% of domestic investment value.

Experts predict that this year, Vietnam will face many challenges from global trade recession and inflation, which will hinder domestic consumption. Attracting FDI back into the market is crucial for both export growth and the domestic consumption market.

Therefore, this is the time for Vietnam to focus on attracting more FDI from the domestic Asian region, while Western multinational companies are struggling with macroeconomic and political tensions.

Opportunities To Attract Asian Investment

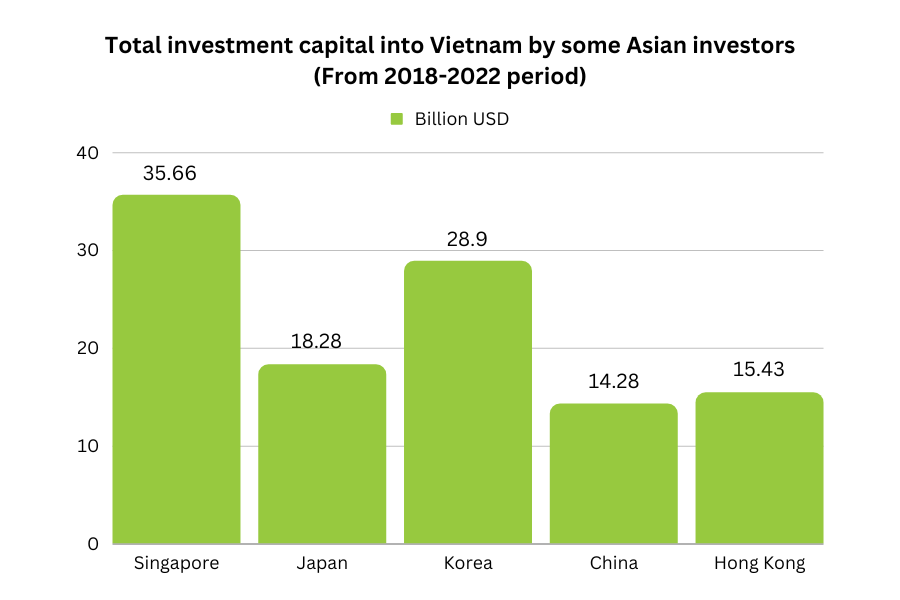

Asian investors have always been among the top investors in Vietnam. In the past 5 years, the leading foreign investors have all come from Asia, including Singapore, Japan, South Korea, and there is an increasing presence of mainland China, Hong Kong, and Taiwan.

According to expert advice, Vietnam has factors that attract inward Asian capital flows such as geographical and cultural proximity, along with the attractiveness of free access to 15 G20 markets through 15 free trade agreements (FTAs) that Vietnam has joined. In addition, the middle class is increasingly affluent and has high income and assets, reinforcing efforts to deepen penetration into Vietnam’s domestic consumer market.

Challenges Arising From Internal Factors

However, Vietnam still faces many challenges in competing with other destinations in the strategy of expanding production chains outside of China (+1). While Thailand and Indonesia are still favorite destinations for the automotive supply chain, Vietnam is moving towards attracting investment in the electronics industry, although this is also an area where India is receiving a lot of attention from investors.

Experts believe that Vietnam needs to improve both soft and hard infrastructure to consolidate its investment attraction advantages.

Soft infrastructure needs to accelerate the consolidation of investor confidence in legal frameworks. Regarding hard infrastructure, it is necessary to develop transportation infrastructure and sustainable development factors for industrial parks, capturing trends that comply with ESG (environmental, social, governance) criteria. Japanese companies consider Vietnam a potential market but face business risks due to the efficiency of administrative procedures, tax systems, laws, visas, and labor permits.

“Therefore, developing industrial parks in Vietnam needs to ensure the integration of sustainable elements and ecosystems to enhance attractiveness and readiness, attracting large and long-term foreign investors,” experts recommend.

Ms. Cao Le Tuong Van, Director of Capital Market & Investment Services at Colliers Vietnam, said ESG would become increasingly important in real estate this year. With the global economy facing many challenges, spending needs to be considered in the long-term. ESG projects with lower operating costs will have many advantages.

Keep following for the latest financial and economic news from the market.

Realtique Co., LTD

+84866810689 (WhatsApp/Viber/Zalo/WeChat)