Thu Thiem: Finalizing Roadmap for an International Financial Center

The image of an international financial center located in Ho Chi Minh City is under construction, but currently with two quite opposite ideas.

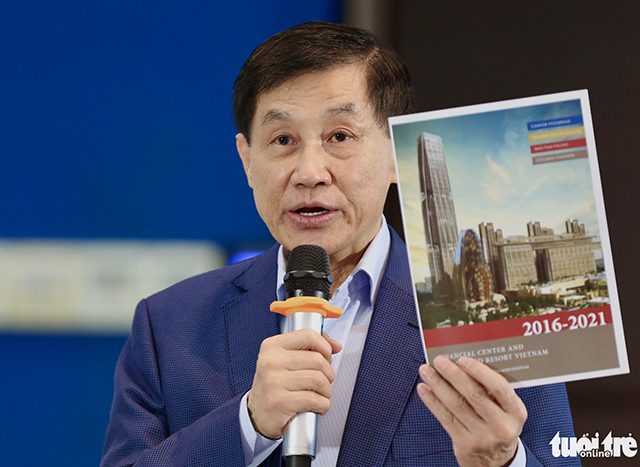

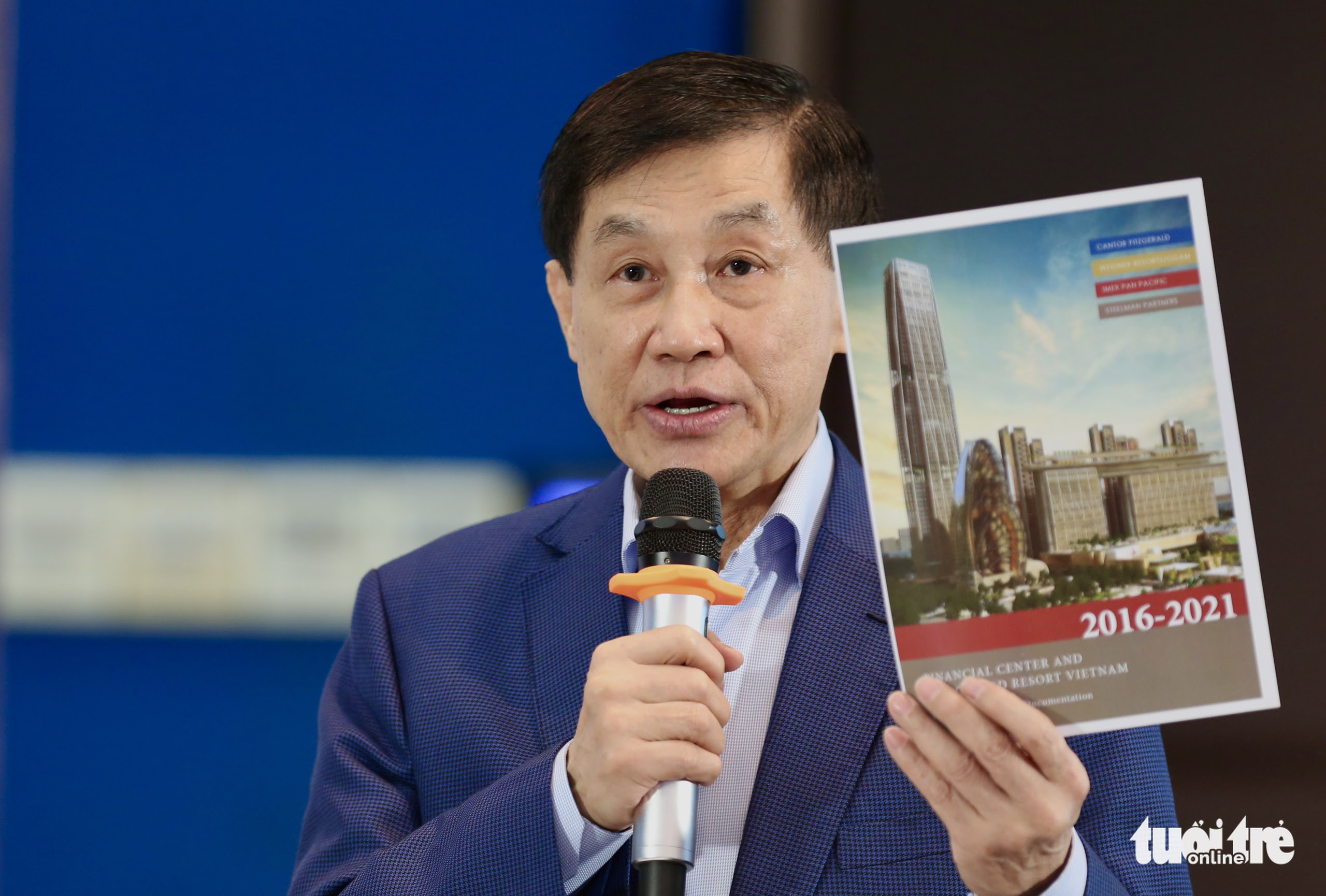

In a seminar last week, Mr. Johnathan Hanh Nguyen, Chairman of the Inter-Pacific Group (IPPG) mentioned about the project to develop a financial center in Vietnam revealing investors have committed to spend USD 6 billion for this financial center and want to build Disneyland there.

However, in the detailed proposal, the Disneyland-style park is only one part of the entertainment service at this center. According to VnExpress, the proposal team also mentioned it would build a casino and tax-free shops… And Mr. Johnathan Hanh Nguyen called this a “non-traditional” financial center.

Many people think a financial center and an amusement park do not seem to have any connection. But the project that Mr. Johnathan Hanh Nguyen mentioned is the result of the recently signed memorandum between IPPG and Ho Chi Minh City to study and develop an international financial center project. The head of the IPPG also committed to deliver the project proposal earlier than the signed deadline 60 days.

The IPPG-funded research proposal is not the only idea that contributes to the shape of an international financial center of Ho Chi Minh City – a mission set out in the Resolution of the 13th Party Congress, February 2021.

Previously, in 2019, Ho Chi Minh City asked Fulbright University Vietnam to develop another proposal for this international financial center. By the end of 2021, this proposal has been sent to the City.

Johnathan Hanh Nguyen, Chairman of IPPG speaks at the discussion session taking place in Ho Chi Minh City, February 17, 2022. Photo: A.H. / Tuoi Tre

Johnathan Hanh Nguyen, Chairman of IPPG speaks at the discussion session taking place in Ho Chi Minh City, February 17, 2022. Photo: A.H. / Tuoi Tre

However, which proposal to choose is a matter of different views on each side

According to the IPPG’s proposal, the financial center should combine traditional financial business like New York, Hong Kong and London, but it can also combine with entertainment & amusement parks like Singapore did with Marina Bay Sands.

Therefore, in addition to modern, complex buildings with activities in the financial – banking industry, the “creative start-up” population; the financial center also has other highlight items such as a commercial center, cinema, casino and sports betting, theatre, resorts, entertainment, duty-free shops…

The team drafted the proposal building a large-scale casino project combined with sports but no racetrack. Strategic investors are licensed to invest in construction for 70 years and can be renewed many times. Investors are also not required to comply with pilot programs with integrated casino, sports betting and resort businesses under current regulations.

In addition, the proposal mentions allowing the establishment of duty-free sales areas and amusement parks. Tax-free purchase limit for Vietnamese customers will be regulated from time to time.

It also clearly states that a strategic investor is one or a group of investors committing to invest at least USD 10 billion in developing an international financial center complex including financial services functions, tourism, resort, hotel and entertainment (including casino).

Meanwhile, Fulbright’s proposal aims at building an international financial center with a pure concentration of inherent functions.

According to Fulbright, Ho Chi Minh City, which is a national financial center, has both existing (banking, securities, insurance) and emerging financial services (digital banking, fintech, bancassurance, financial services, fund management services – asset management, corporate M&A market and derivatives…).

In the future, in order to develop further, the city needs to remove mechanisms to continue developing these financial services, along with new areas such as off-shore finance, listing and securities trading (cross-listing), green capital, venture capital, hedge funds, commodities exchange market…

Thus, according to Fulbright’s project, three components of the financial center of Ho Chi Minh City will include: money market and banking system, capital market and commodity market.

It believes the financial market in Ho Chi Minh City needs to develop strongly the banking system and digital securities market, thereby integrating into global networks. Financial groups here must play the role of providing cross-border services, leading the development of money markets, foreign exchange, stocks, corporate bonds and derivatives. In addition, the international financial center also plays the role of connecting Fintech services and mobilizing international investment capital to finance startups in Thu Duc City.

The Thu Thiem peninsula on the left and District 1 on the right is widely agreed to be the location of the core location of the International Financial Center in Ho Chi Minh City. Photo: Quynh Tran

The Thu Thiem peninsula on the left and District 1 on the right is widely agreed to be the location of the core location of the International Financial Center in Ho Chi Minh City. Photo: Quynh Tran

Sharing about the international financial center, Dr. Can Van Luc, a member of the National Financial – Monetary Policy Advisory Council, said the unification of its shape needs to be done soon because so far people have 3 different ideas.

First, they will think of a financial building, banks, securities, insurance and Wall Street-style investments. Or second, as an investment center, attracting many large investors to that area. The third is whether it is an entertainment center associated with casinos, tourism, etc. However, he added, the financial world has transformed rapidly with digital transactions, digital investments and digital currencies.

“Perhaps the vision of the financial center has to be clarified before getting it formed,” he said.

In addition to the obvious differences in the shape of the international financial center, the two proposals also have some separate views on infrastructure construction, especially supporting “soft” infrastructure.

With Mr. Johnathan Hanh Nguyen, the research team emphasized the role of building hard infrastructure such as transport and logistics and he mentioned a lot with “soft” infrastructure. It is a system of management, supervision, application of specific regulations (such as green card for entry, information technology infrastructure to monitor transactions…), separating preferential policies (tax incentives, favorable capital flows…) from the current production, business and investment mechanisms in Vietnam.

As for Fulbright’s one, incentives by a breakthrough policy mechanism in the provision of financial services will be much more effective and attractive than incentives for land and taxes.

The preparation of “soft” infrastructure was addressed by Fulbright by establishing the “Ho Chi Minh City International Financial Center Development Council”. This council will recommend breakthrough policies on financial liberalization and financial integration for the financial center, but also with adequate risk management and control mechanisms, propose breakthrough policies, license under a limited-time trial mechanism and perform the role of state management under a trial mechanism with financial technology services…

The two proposals currently offer different roadmaps. If the IPPG evaluates that Ho Chi Minh City is eligible to become an international financial center from 2023-2030 after 3 years of promulgating specific mechanisms and policies, attracting strategic investors and establishing a management board Theoretically, Fulbright sets a date from 2031 onwards. According to Fulbright, the nearly 10-year period of the roadmap serves to research and formalize new financial institutions, which are unprecedented in Vietnam.

In general, up to now, two proposals of the two research groups have been placed on the desks of the leaders of Ho Chi Minh City.

According to Mr. Nguyen Ngoc Hoa, Chairman of Ho Chi Minh City Financial Investment Company (HFIC), in April, the proposal will be completed and submitted to the central authority. HFIC has completed consulting experts and formed the outline of the project, preparing the content for the city.

Realtique Co., LTD

+84866810689 (Whatsapp/Viber/Zalo/Wechat)