Vietnam’s Processing & Manufacturing: Challenges & Recovery

Challenges:

The political conflict between Russia and Ukraine this time, according to Dragon Capital and many other experts, has a negligible impact on Vietnam’s trade. The proportion of Russia and Ukraine’s trade with Vietnam accounted for only 1% and 0.1% of import and export turnover, respectively.

However, the role of Russia and Ukraine is increasing in international trade, accounting for 1.8% of total global exports. Vietnam will still suffer some impacts due to the two countries’ important positions in the global energy and supply chains.

The most visible impact on Vietnam’s economy, according to Dragon Capital, is inflationary pressure due to rising oil prices. In Vietnam’s inflationary basket of goods, fuel currently accounts for 3.6% while transportation accounts for 9.7%.

Vietnam’s fuel price also includes many different taxes (import tax, environmental tax) – considered as a market stabilizing factor. To control inflation, the Government can make some policy adjustments.

Currently, the government has funded a refiner to solve temporary financial difficulties and bring production back to normal. The Ministry of Finance is also preparing to auction 100 million liters of RON 92 gasoline (domestic gasoline) from the national reserve this month to increase supply.

In addition, the Prime Minister asked the Ministry of Finance to consider reducing the environmental tax on gasoline. This option will be discussed in the next session of the National Assembly.

Currently, the environmental tax accounts for 15% of the domestic oil price while the total taxes and fees account for 42% of the oil price. “Not particularly concerned about inflation based on oil prices alone,” Dragon Capital said. There are other sectors in the consumer price basket such as electricity and water (3.9%), healthcare (5.4%), or education (5.5%) that the Government can flexibly adjust. However, Dragon Capital also raised concerns when the price of pork, rice and poultry increased accordingly.

In general, the direct impact of Russia-Ukraine tensions on Vietnam’s trade is very limited. But Vietnam may still be impacted by global supply chain disruptions,

Russia and Ukraine are the world’s major suppliers of nickel, neon, krypton, aluminum and palladium, which are important raw materials for the production of semiconductor chips. Therefore, any disruption in the supply of Russian goods could cause a bottleneck in the output of the electronics sector, Dragon Capital assessed.

Vietnam does not directly import these materials from Russia and Ukraine but imports chips from Korea, Japan and Taiwan. In 2021, Vietnam bought $59 billion worth of semiconductors, phones and electronic components from these markets, accounting for 17.6% of the total import value.

East Asian countries have voiced their support for Western economic sanctions and may take some measures against Russia. Therefore, any tension between Russia and these countries could impact the cost of manufacturing mobile phones and electronics in Vietnam, Dragon Capital said.

Besides, the production picture is not quite as good as businesses are still facing problems of limited supply. This is holding back output growth, according to IHS.

“Companies are still having a hard time convincing a large enough number of workers to return to their factories to deal with the backlog of work, while raw materials are still scarce,” said Andrew Harker.

Manufacturers said input prices continued to increase sharply, reflecting the increase in selling prices of raw materials by suppliers. The company also mentioned the recent galloping oil price. Shifting the cost burden to customers has made the monthly selling price higher than the previous month for 18 months. The growth rate was faster than in January.

Purchase activity of input goods increased sharply in February as companies tried to import goods to support increased output. As a result, inventories of purchased goods increased at the fastest rate in 10 months, becoming the largest increase ever recorded. Finished goods inventories also increased in the middle of the first quarter, although the increase was only slight.

Survey respondents said that this increase reflected not only the increase in the number of new orders but also the difficulties in delivering finished goods to customers amid transportation difficulties.

However, the IHS side also informed that manufacturers are hoping difficulties will gradually ease in the coming months, helping output get out of this stagnation.

Vietnam PMI in February continued to increase. Photo: IHS Markit

Recovery:

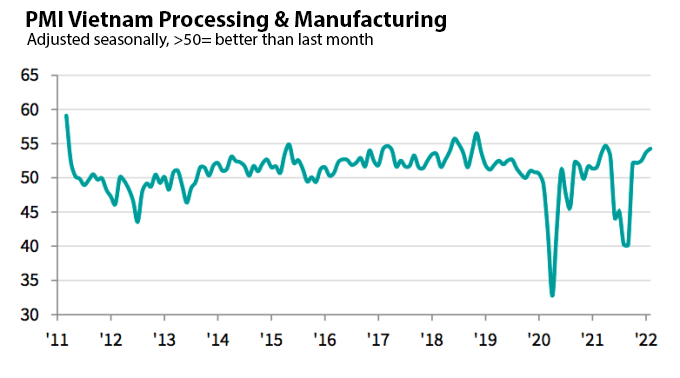

Vietnam’s February PMI reached 54.3 points, higher than the previous month and the fourth consecutive month of increase.

The Purchasing Managers’ Index (PMI) is conducted by surveying leaders of private manufacturing and service companies to assess the overall health of the economy. PMI takes the threshold of 50 points, in which, the manufacturing sector is confirmed to have an expansion if PMI is above 50 and conversely, a contraction if it is below 50.

In February, Vietnam PMI reached 54.3 points, up from 53.7 points in January, showing four consecutive months of growth.

“Vietnam’s manufacturing sector continues to show good resilience to Covid-19,” commented Andrew Harker, Economic Director at IHS Markit.

Accordingly, business conditions have improved during the past 5 months after being disrupted by the Delta variant. Overall growth momentum improved thanks to stronger customer demand. New orders rose sharply and the rate of increase was faster than reaching a 10-month high.

On the other hand, international demand also improved in February, causing export activities to continue to increase significantly. Increased new orders and stable business conditions contributed to a fifth straight month of increase in manufacturing output. Like the number of new orders, the rate of increase in output was also the most significant since April 2021.

These factors have boosted business optimism about the outlook for output next year. More than half of the survey respondents said that production is expected to increase.

Realtique Co., LTD

+84866810689 (Whatsapp/Viber/Zalo/Wechat)