TULIPMANIA AND CRAZINESS OF THE CROWD

Monday, it’s quite interesting to hear:

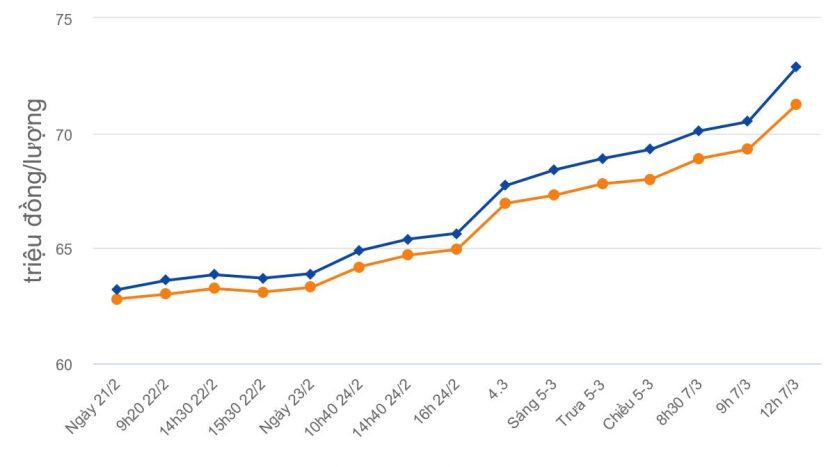

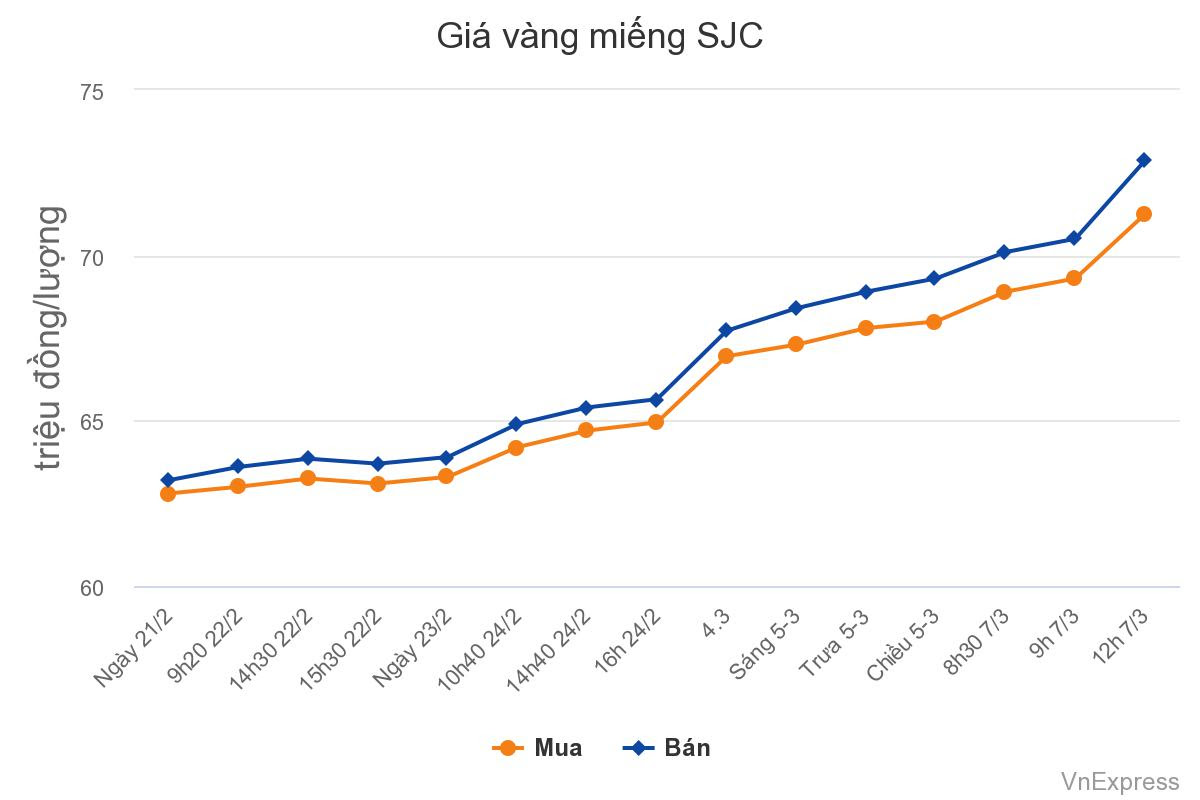

- SJC gold spiked by nearly $180, continuing to set a new peak at $3,120 a tael of gold

- VN-Index, closed down 6.28 points (0.42%) to below 1,500 points. VN30-Index dropped 16.22 points (1.06%) to 1,509 points. Meanwhile, at the rest, many groups of stocks related to basic commodities soared. Recently noticed groups such as oil and gas, steel, fertilizer or coal stocks all gained strongly, many stocks closed at ceiling prices.

SJC gold spiked by nearly $180

Oil and gas, steel, fertilizer or coal stocks all rose sharply

TULIPMANIA AND CRAZINESS OF THE CROWD

In 1634, the Netherlands witnessed the most insane collective syndrome in history. Today, this syndrome is known as “Tulipmania”.

The frenzy of owning tulip carriages – especially rare specimens – has engulfed the Netherlands. We can’t imagine this craze, but it happened.

The price of tulips skyrocketed to unexpected heights. By 1636, speculative demand for tulips also led people to buy and sell rare flowers on the stock exchange of Amsterdam as well as many other cities in the Netherlands.

Very quickly, everyone bets on tulips. As with other syndromes, “everyone has the illusion that the passion for tulips will last forever, that wealth will flow from all over the world to the Netherlands, and that people will pay any price to own it.”

The European elite will (then) gather on the shores of Lake Zuyder Zee, and poverty will be expelled from Dutch territory.”

Tulip speculators, like stock speculators, also speculate on the volatility of “tulip stocks”.

For a period of time, everyone made a lot of money. Many people suddenly became rich – “Nobility, commoners, farmers, mechanics, tailors, servants, housekeepers, even those who sweep chimneys and clean up old clothes, are immersed in tulips”.

When the frenzy spread, people were willing to do the most shameless things to enter the get-rich-quick game with tulips. Homes and properties are up for sale at ridiculous prices for cash on this bet.

Of course, like crowds of fanatics, the hysteria eventually dissipates, but the result it leaves behind is an empty pocket.

Entering the collapse phase, the price falls even faster than it rises.

Tulips, National Flower of the Netherlands

Crowd psychology in tulipmania is not much different from the crowd hysteria today when hearing information about fluctuations in the price of gold, oil & stocks related to oil and gas, steel, fertilizer or charcoal.

Interestingly, crowd hysteria is not often observed, say rarely.

Although very keen to see and control how the crowd operates, behaves and thinks. But the more we want, the more we can’t touch, hold or visualize it…

Until there is an event that “triggers” and shows the ability to “go viral” as clearly as NOW:

Tensions between Russia and Ukraine inadvertently make the movement of the crowd appear, helping us to see what this speculative crowd is doing, clearly in broad daylight.

This is a rare phenomenon, like a solar eclipse, that we should just watch from the sidelines.

Or if you accidentally get involved, please control your emotions and follow the 80-20 investment split ratio, of which 20% is for high risk speculative budget.

Good luck!

Realtique Co., LTD

+84866810689 (Whatsapp/Viber/Zalo/Wechat)