Correct Understanding of Resolution 18: High Taxation on Owners of Many Properties

On June 16, 2022, the Central Committee issued Resolution 18 aiming at the efficiency in using the country’s important resource, land; not let land be degraded, destroyed, wasted, corrupt, negative.

Resolution 18 states

- Regulations on higher tax rates for users of large areas of land, houses, land speculation… At the same time, there are preferential policies for tax, land use levy and land rent suitable to the areas, poor households, ethnic minorities, families of people with meritorious services to the revolution…

- Remove the current outdated land price bracket. Agencies have mechanisms and methods to determine land prices according to market principles. However, the land price list is still maintained according to the criteria and inspection process, for easy monitoring during the price list building.

- Ensure the healthy development of the real estate market, strictly control: all transactions must be done through agencies, payment via banks, no cash…

[[sc-btn||text=View Resolution 18 (Apply Google auto-translation or equivalent plug-ins for your understanding)||type=url||value=https://vnexpress.net/nguoi-co-nhieu-nha-dat-se-bi-ap-thue-cao-4479951-p3.html?inf_contact_key=facabb224440322679a1615d9189e403&inf_contact_key=6dfe5cddaf062f4acb59b0e7c439a7f71b0a3f0fd3ee5d9b43fb34c6613498d7]]

Resolution 18-NQ/TW – Renovating and reorganizing the political system’s apparatus

In general, Resolution 18 is an important step of the State to continue renovating and perfecting institutions and policies, improving the effectiveness and efficiency of land management and use, creating a driving force to bring Vietnam to the next level, becoming a high-income developed country.

This is something that must be done sooner or later in order to develop policies and laws on land use tax according to international practices and in line with Vietnam’s development level.

Practice shows that many reforms and responses to land policies and laws have been implemented for nearly 10 years.

However, the management and use of land still have many limitations

- Some innovation contents have not been institutionalized or institutionalized slowly and incompletely; The Land Law and a number of related legal documents are overlapping, inconsistent and synchronous. In some cases, policies and laws on land have not kept up with the rapidly changing reality;

- The system of planning, land use plans and master plans with land use have not yet ensured the overall, uniform and synchronous character;

- The planning quality is not high, the long-term vision is lacking and the requirements for sustainable development are not met;

- The allocation and lease of land in some places still have many shortcomings and mistakes. The settlement of residential and production land for ethnic minorities in some places is still slow, ineffective and has not yet achieved the set targets and requirements;

- The compensation, support, resettlement and land recovery in some localities are still slow, incorrect and according to the provisions of the law, affecting the rights, lives and livelihoods of land owners, causing losses to the state budget;

- There is no effective mechanism and no resolute handling of projects that are behind schedule or do not put land into use;

- The real estate market, including the land use rights, has not developed stably, transparently, sustainably, with many potential risks;

- The methods of valuation and auction of land use rights are still inadequate and not suitable with reality;

- There is no sanctions to handle violations in land price determination, land use right auction;

- The database and land information system have not been completed;

- Land has not been exploited and used effectively to become an important resource for the country’s socio-economic development…

The causes of the limitations and weaknesses are due to

- There has not been a high consensus on awareness on a number of issues related to land management and use in the socialist-oriented market economy, especially about the importance and meaning of total ownership on land, which is represented by the State and uniformly managed by the State;

- Awareness of policies and laws on land is sometimes incorrect and incomplete;

- Land policies and laws have many limitations, inadequacies, overlaps and inconsistencies, affecting management efficiency, creating loopholes for many individuals and organizations to take advantage of, corrupt, causing loss and waste of state property…

Specific objectives of Resolution 18

By 2025

By 2023, amendments to the 2013 Land Law and a number of related laws must be completed, ensuring uniformity. Completing the construction of a digital database and national information system on land in a centralized, unified, synchronous, multi-purpose and inter-connected manner…

By 2030

The legal system on land has been basically completed synchronously and consistently, in line with the institution of developing a socialist-oriented market economy.

Overcome the state of wasteful land use, fallow land, pollution, degradation and the problems in land management and use left behind by history.

Land is an important resource that directly affects the quality of life of a country

In addition to Resolution 18 above, to prevent land fever, measures such as tightening separation land plots for sale, tightening credit to run into real estate are also being applied.

The Government’s policy changes on the real estate market initially created a calmness in the market. Real estate investors are more cautious and more careful to observe upcoming market and policy movements.

In this timing, what can you do?

-

Evaluation of the portfolio of real estate owned

Consider whether the owned real estate still has growth momentum, and how long it will grow (1-2 years or 3-5 years…). Then, sell the real estate with no growth momentum.

-

Long-term capital allocation

To ensure timely adaptation to upcoming changes, investors should aim for long-term properties (> 3 years), to always have abundant cash flow, avoid risks and timely adaptation to new policy changes

-

Planning and continuously accumulating real estate knowledge

Always identify problems in real estate from many perspectives, select appropriate and objective expert opinions to come up with a specific real estate investment plan, suitable for your own finance.

Make a clear, long-term, sustainable real estate investment plan, solidly backed with adequate cash flow

Refer to the land tax rates of neighboring developed countries

- Hong Kong:

Hong Kong charges a land use tax on the rent the landlord receives from the property. And this tax rate is up to 15%.

For example: If a landlord has 2 apartments: 1 to live in and 1 to rent out. Then the apartment used to rent will receive the rent. The landlord needs to claim this minus the 20% deduction for repairs to multiply with 15% land tax.

[[sc-btn||text=See more about how to calculate Hong Kong land tax here||type=url||value=https://asiabc.co/guide-to-hk/property-tax-of-hong-kong-explained/?inf_contact_key=3d30c3239eec655c497c905da649e7bf&inf_contact_key=a774389ae13f3a8d00e90d63a30a498c842e902fbefb79ab9abae13bfcb46658]]

- Singapore:

Singapore is one of the top developed countries in the region and is more strict in the regulation of land use tax.

Land use regulations and transparent management institutions have helped the country achieve high efficiency in land planning and use.

In Singapore, two types of land tax are applied:

- Owner-occupier tax rates

- Non-owner-occupier tax rates

Based on a transparently updated real estate price framework, real estate in Singapore is easily valued annually, known as the property’s annual value.

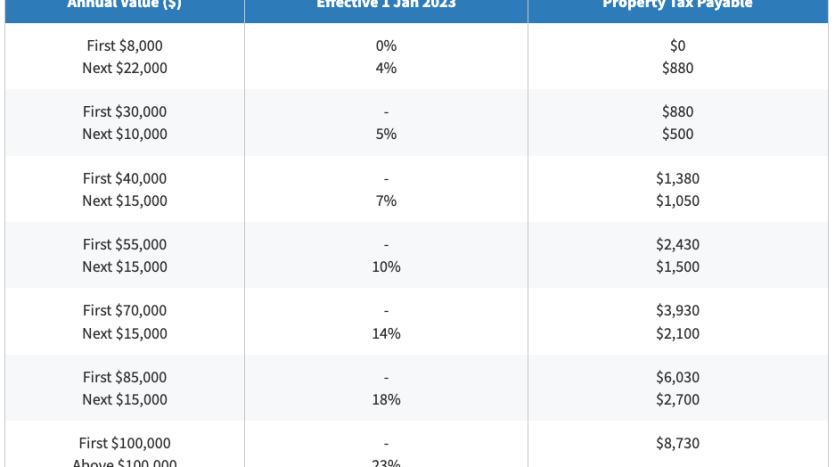

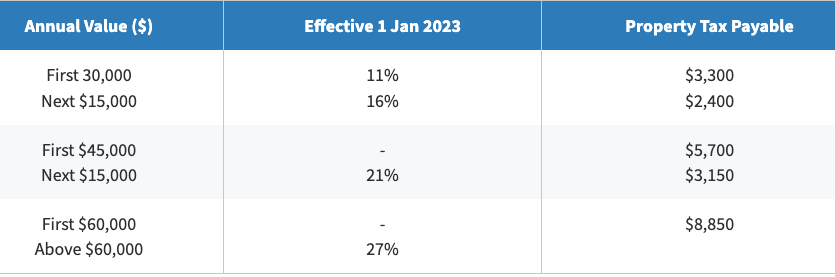

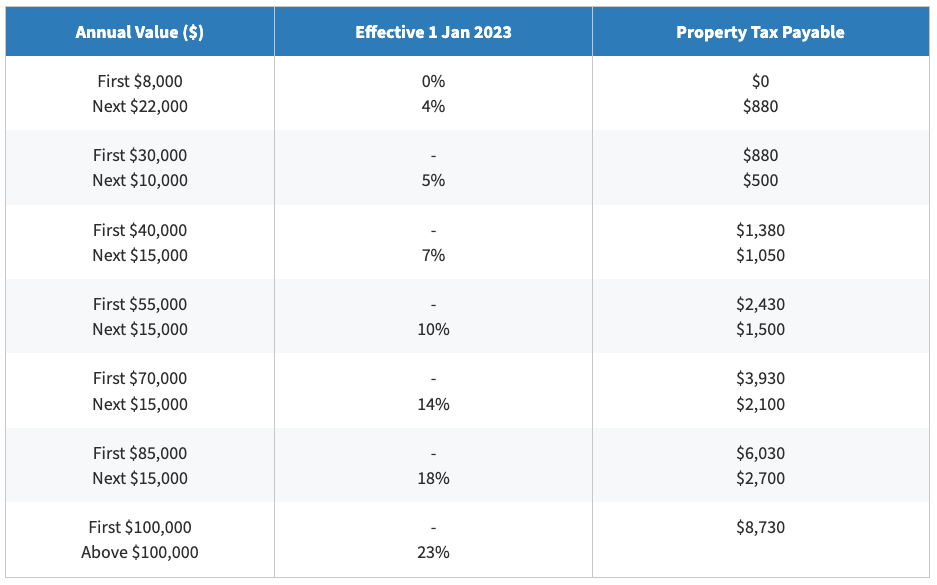

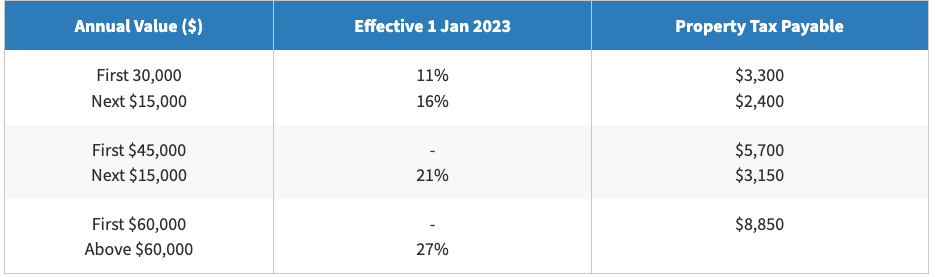

The above 2 taxes are applied on the annual value of real estate as follows:

For example, if your property’s annual value is $30,000 and your tax rate is 10%, you’ll pay the equivalent of $30,000 x 10% = $3,000 per year.

The above two taxes are cumulatively increasing as follows:

Owner-occupier tax rates

Non-owner-occupier tax rates

[[sc-btn||text=See more how to calculate Singapore land tax here||type=url||value=https://www.iras.gov.sg/taxes/property-tax/property-owners/property-tax-rates?inf_contact_key=5b0f3c8f15fd89bca0370d4e765cb71a&inf_contact_key=b7c2b365353ebafa4be763c63b90466e16358d5485884e2f31e6019a0d26c8b0]]

Looking back at Vietnam, the roadmap for completing Resolution 18 to 2025 and 2030 still has many challenges to realize solutions that are realistic, up-to-date and suitable with economic conditions and development level of Vietnam.

All that real estate investors can do now is calmly observe, always take the initiative in capital sources and maintain a long-term, sustainable investment stance.

Certainly, the upcoming changes will be more positive than unnecessary anxiety.

Realtique Co., LTD

+84866810689 (WhatsApp/Viber/Zalo/WeChat)