Where To Shelter In Time Of Inflation?

36% of investors’ concerns when investing is inflation. In 2023, Vietnam’s inflation is forecasted to be at 3.5% while in the world it is still around 10%.

Investment strategies need to be reconsidered, especially for amateurs.

Where is the place where our money is effectively protected but still makes a profit?

Return To Familiar Investment Channels…

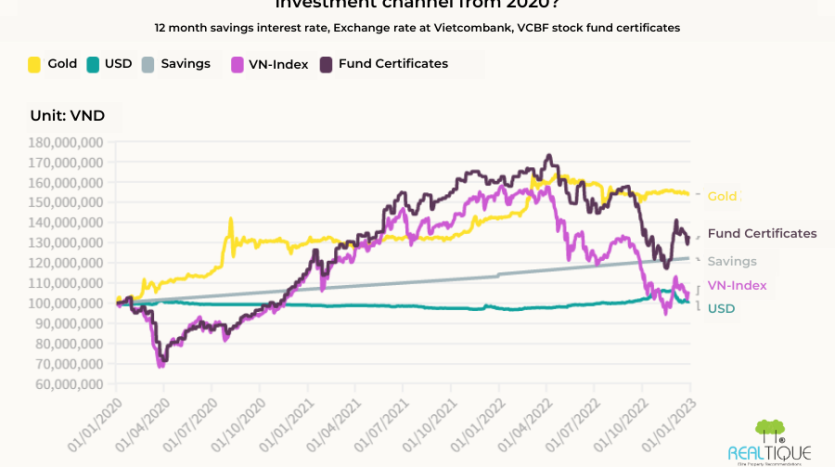

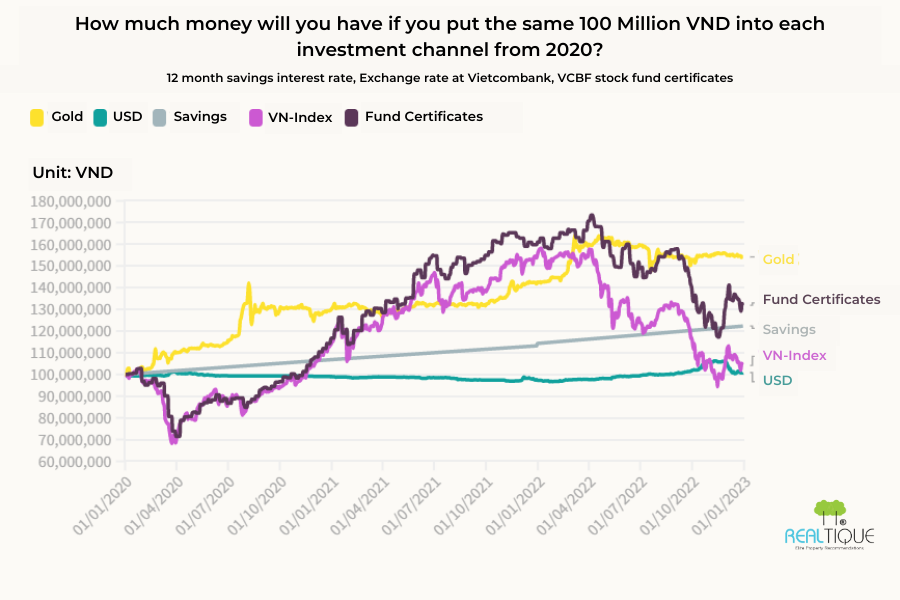

Profitability performance of familiar investment channels in the period 2020-2022

Gold

According to a market survey from VnExpress, gold is still a traditional investment channel and trusted by 57% of investors. During the Covid-19 period, the price of gold bars had many fluctuations but returned to stability in 2022. In general, during three years, the price of SJC gold increased by more than 50%, from 42 million to 67-68 million dong per tael in end of 2022 and if you sold by March 2022, it could be more than 60% in profit

People rush to buy gold on the Day of God of Wealth

This is explained by when inflation occurs, the demand for investment in precious metals increases, pushing the demand for gold to increase but the supply is not enough, causing the price of Vietnamese gold bars to increase. Although this channel is still expected to increase in price in the near future, it is difficult to achieve the expected volatility like before the epidemic.

Bank Savings

Bank savings is considered a low-risk investment option because the interest rate is quite stable from year to year. In the period of 2020-2023, savings interest rates fluctuate at 5-7 %/year. If you save 12 months with an amount of 100 million VND from the beginning of 2020, and automatically renew both principal and interest, by the end of 2022, you will have 122-125 million VND.

Bank savings is considered as a safe way to hold money

From the second half of 2022 until now, interest rates have increased rapidly and strongly to 8-11 %/year when system liquidity is tight, deposits maturing in 2023 will have better interest rates.

The move to raise savings interest rates of banks is forecasted to last until the first half of 2023, after which it will move sideways and cool down.

USD

USD is considered a poor profitable investment channel in the period of 2020-2023 when there are not too many significant fluctuations. With the policy of anti-dollarization of the economy and flexible exchange rate control of the State Bank, those who invest in USD have almost no profit, not to mention the deficit because of the “opportunity cost” compared to the bank savings.

Stocks, Bonds, Cryptocurrencies

Stocks and bonds are the choices of around 50% of people surveyed. Besides traditional investment channels, 73% of them still believe that digital assets still play an important role in any investment portfolio.

Trading at a stock exchange

These forms are much riskier than holding gold, USD, or bank saving. Instead, profitable performance will have a lot of potential depending on the industry, the type of stock, the time to buy and sell, and the strategy of each individual investor. At some point, the profitability of these investment channels was up to 200%, making many investors craves to earn quickly from stocks and cryptocurrencies. However, these are investment channels not for amateurs or with little investment experience.

However, the reality from mid-2022 shows that the bond market seems to freeze before the move from the State Bank of Vietnam, and at the same time, the collapse of the FTX brings a dark future for virtual currency trading channels.

Or Find New Solutions…

Real estate and digital assets are investment channels that are too familiar to those who are experienced and accept high risks, but if you are a newbie, I have another financial solution for you.

Still buying real estate…

Still investing in cryptocurrencies…

But you will buy a piece of cake, what do I mean?

That is, real estate will be tokenized on a crypto platform, then divided among many owners around the world.

The properties will be divided and valued in tokens

If you only own USD 10, you can still own an real estate! And get the profit share on the percentage of ownership.

You can even sell your ownership at ANYTIME, EASY AND QUICK, to buy other more potential real estate.

However, you still need to find out carefully before spending, and I will be a great help for you.

[[sc-btn||text= Find Me Here!||type=email||[email protected]]]

Depending on each person’s experience, finance, and strategy, the choice of investment solutions and financial management need to be carefully considered, especially in a volatile period like the present. In particular, investors must have a deep knowledge of the field they are about to enter to have smart strategies for their cash flow.

An appointment to talk about your investment plan at Landmark 81, why not?

Please contact Realtique for latest update of special projects and events on the market.

Realtique Co., LTD

+84866810689 (WhatsApp/Viber/Zalo/WeChat)