How To Help The Economy Of Ho Chi Minh City?

The economy of Ho Chi Minh City has fallen to the bottom 5 among centrally governed cities and ranks 8th out of 63 provinces and municipalities. This is the current situation as the city’s growth in the first quarter only reached 0.7%.

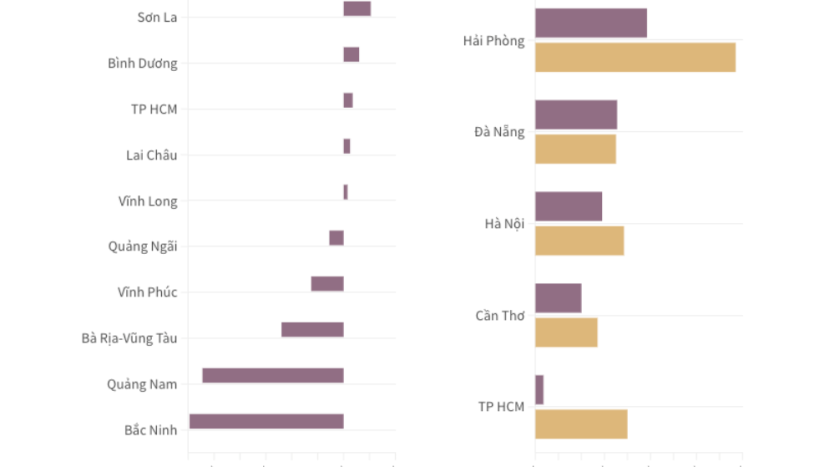

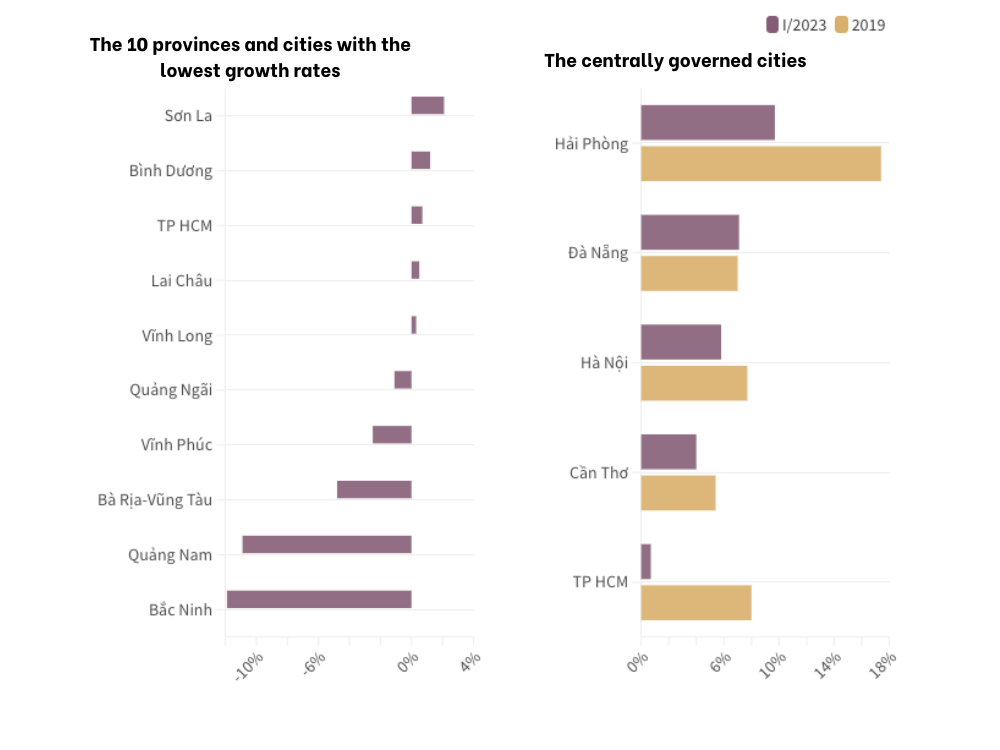

The 10 provinces and cities with the lowest growth rates including Ho Chi Minh City

Why is the economy of Ho Chi Minh City losing momentum in the first quarter of 2023?

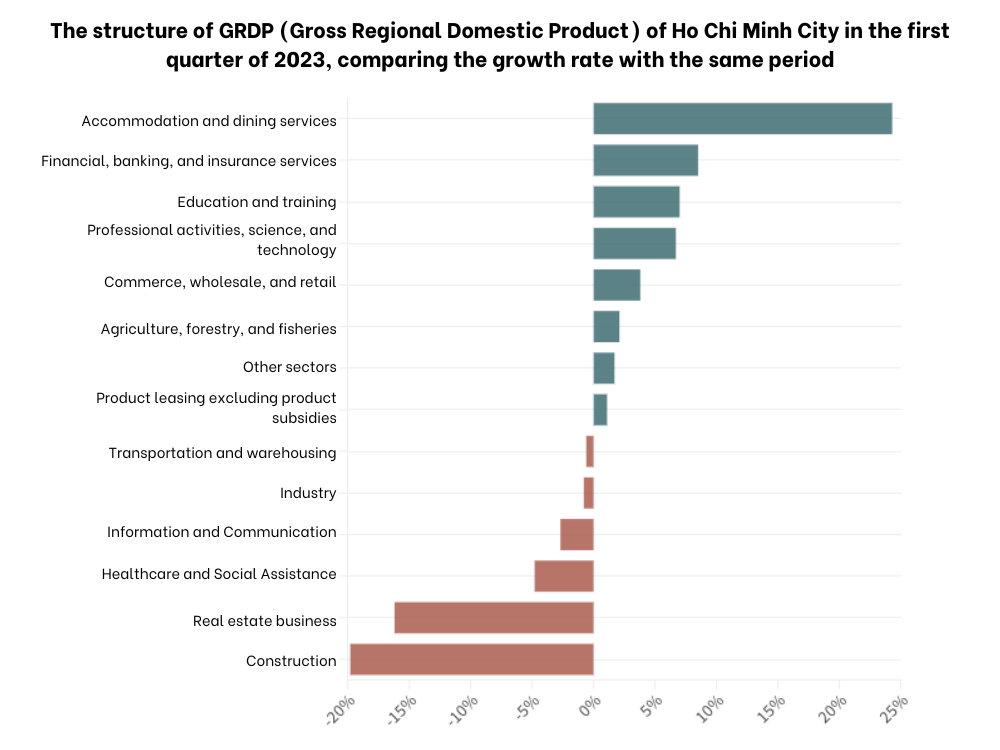

There are multiple explanations for the slow economic growth in Ho Chi Minh City, but from an objective perspective, it is likely that the city is experiencing a localized domino effect as three major pillars that contribute significantly to the economy are facing challenges: real estate, construction, and industrial manufacturing.

- Real Estate: The real estate market has been experiencing a downturn since the latter months of the previous year. According to data from Cushman & Wakefield, a multinational research company, apartment liquidity in the fourth quarter of 2022 decreased nearly 70% compared to the same period. Many experts believe that the bond crisis, along with legal issues faced by some major real estate enterprises, have affected the market.

- Construction: As the real estate sector declines, the construction labor force is the first to be impacted. When Covid-19 struck, the income of the construction industry was already affected, and now with the additional blow from the downturn in real estate, the situation has become increasingly difficult.

- Industrial Manufacturing: For the industrial sector, export orders have gradually diminished since the middle of last year due to weak demand from major markets such as Europe and the United States. In the first three months of the year, 70% of important industrial sectors experienced declines, with traditional sectors like garment and footwear being hit the hardest, with around a 20% decrease. A quick survey conducted by the Ho Chi Minh City Business Association (HUBA) at the end of February showed that only 65% of businesses were able to maintain an average monthly salary of 10 million VND. Last year, 80% of businesses were able to meet this level.

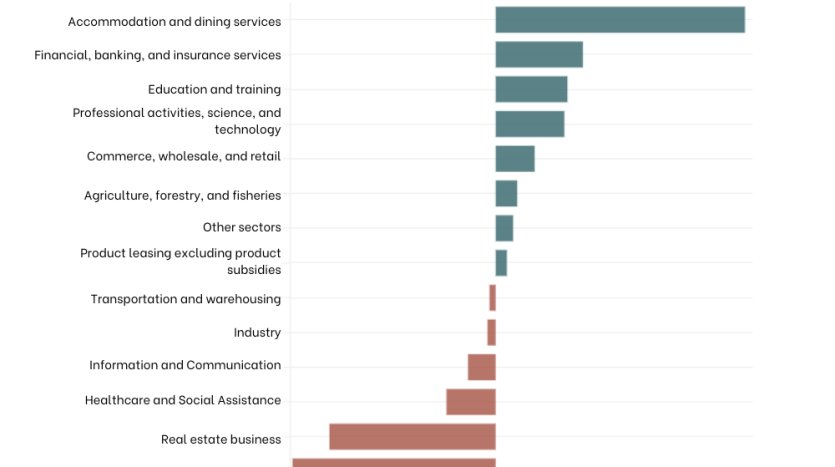

Industries with negative growth that affected Ho Chi Minh City’s growth in Q1/2023

As we can see, a local domino effect is taking place, impacting the three pillars mentioned above, leading to reduced income and tightened budgets for workers. The service sector, which constitutes two-thirds of the city’s economy, is also experiencing a decline.

Guardian, a retail chain with nearly 80 stores in Ho Chi Minh City, serves as evidence of this trend. Even for essential products like shampoo, consumers are opting for cheaper brands compared to before.

Ho Chi Minh City struggles to spend money

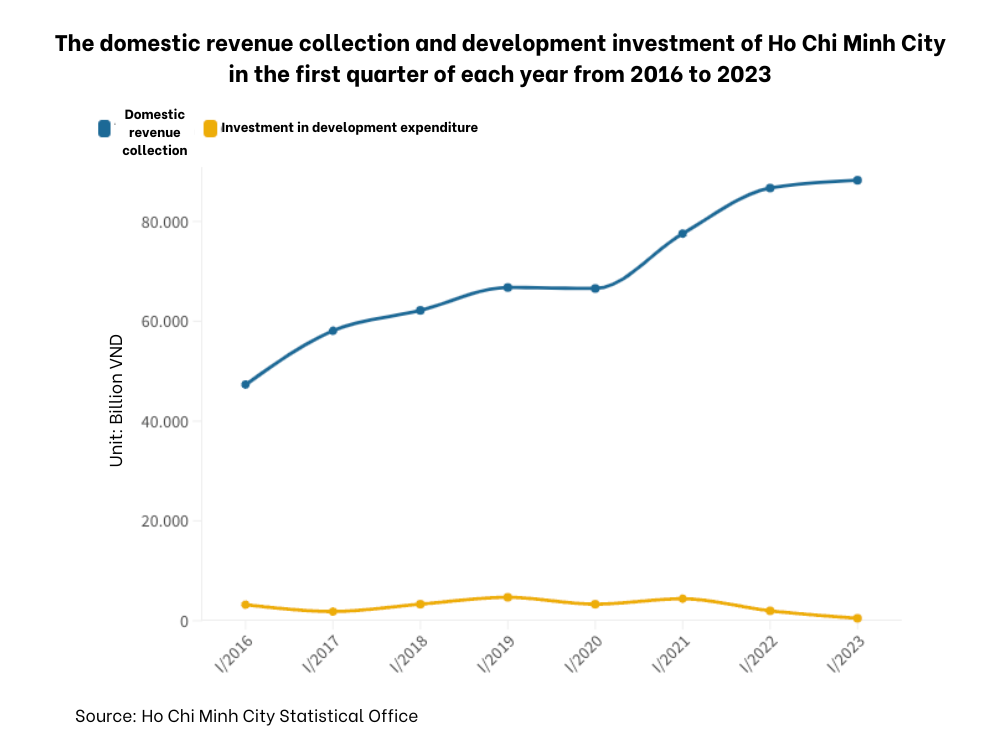

People are cautious in spending, businesses are capital-starved, and public investment is sluggish, causing the money flow to be unable to enter the economy.

Since September last year, deposit interest rates have continuously reached new highs, at times reaching 12% per year.

Along with the bond crisis, banks face difficulties in mobilizing money. Business owners are also hesitant to borrow due to high credit interest rates.

As a result, in the first three months of the year, bank loans to individuals and businesses in Ho Chi Minh City increased by only 0.3%, equivalent to one-fifth of the national figure. On the other hand, deposits decreased by 5% compared to the end of the previous year.

These are unusually low figures for the economic center of the country but align with the meager growth rate of 0.7% in the past quarter, according to Dr. Nguyen Huu Huan (Ho Chi Minh City University of Economics)

The demand for loans from businesses and individuals is sluggish, and capital mobilization is also slow.

Businesses are currently reluctant to borrow for investment and expansion of production and business. This is due to high interest rates, coupled with weak demand both domestically and internationally. Individuals are also waiting for interest rates to decrease before considering borrowing for consumption.

Real estate businesses, in particular, face even greater difficulties due to the existing mechanisms. Ho Chi Minh City currently has over 150 land-related projects entangled in legal issues. Despite the city’s weekly efforts to resolve these obstacles, only 5 housing projects have been approved for capital mobilization in the past three months.

The downturn in the economy in the first quarter is a risk that has been pointed out by experts for Ho Chi Minh City since late 2022.

The solution to accelerate the economic growth of Ho Chi Minh City

When businesses lack capital and consumers reduce their spending, the last resort is public investment.

However, the reluctance of the implementation machinery is a barrier, despite the government introducing many policies to promote disbursement.

Additionally, administrative procedures are also hindrances that slow down business progress. According to a survey by HUBA, land and construction are still the lowest-rated administrative areas by businesses. Nearly 60% of respondents in the survey rated the effectiveness of support from management agencies in these two areas as poor or average.

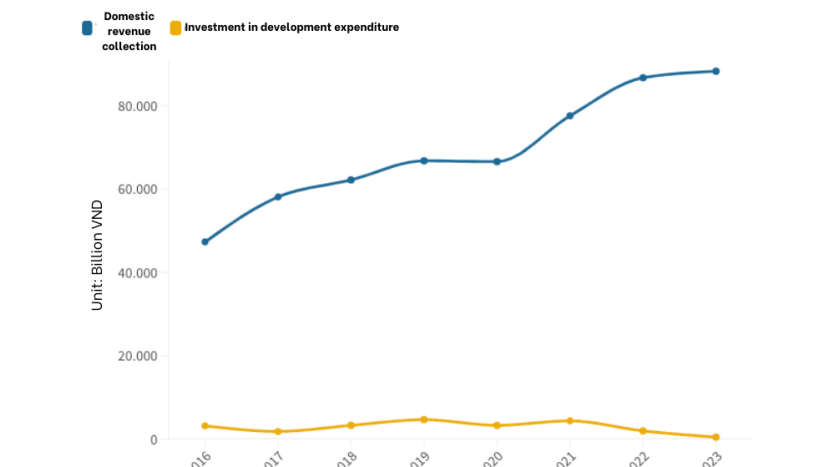

Domestic revenue collection and investment expenditure for Ho Chi Minh City Q1 annually during the period 2016-2023

Chairman Phan Van Mai also emphasized the need to focus on what we currently have when facing difficulties. In this regard, public investment will take the lead, followed by resolving obstacles for private sector projects.

Currently, the city still has around 42,500 billion Vietnamese dong of budget capital waiting to be spent in the remaining 9 months of the year.

Representing the construction and materials business group, Mr. Dinh Hong Ky hopes for more vigorous disbursement of public investment. In the context where the domestic and global markets are still uncertain in terms of recovery, businesses are eager to access public investment projects to maintain employment for workers and overcome challenges.

- Proposal to grant stronger autonomy to Ho Chi Minh City by the central government: “The city must have higher autonomy. It is different when things are favorable, but during difficulties, the distribution of power and responsibility is clearly inadequate,” said Mr. Tran Quang Thang, Director of the Institute of Economics and Management of Ho Chi Minh City and a representative of the People’s Council.

- Reducing interest rates and taxes for businesses: Sharing the same viewpoint, Mr. Nguyen Minh Cuong, Chief Economist of the Asian Development Bank (ADB) in Vietnam, evaluates that those responsible seem to be hesitant and therefore there should be stimulating policies in place. In addition, he recommends that the central government prioritize growth-oriented policies, which means continuing to reduce interest rates and cut taxes and fees for businesses.

- Announcing a clear direction for monetary policy governance: Mr. Nguyen Huu Huan believes that the State Bank of Vietnam needs to announce a clear direction for monetary policy governance to unleash financial resources. When individuals and businesses are still uncertain about interest rate trends, not knowing whether they will increase or decrease, they cannot effectively plan their production, business, and investment activities. Only when the policies are implemented can businesses begin their operations, but there will be a significant time lag in their impact on the economy.

In March, the macroeconomic context began to be “more favorable” as the State Bank of Vietnam reduced the benchmark interest rate. The rate hikes by the U.S. Federal Reserve also slowed down. This is an opportunity for Ho Chi Minh City to address existing issues and regain the pace of development before new fluctuations arise.

According to Dr. Tran Du Lich, choosing the right priorities and resolving the stagnation of the bureaucracy are the key points for Ho Chi Minh City to rise from the low growth in the first quarter. “We need to allocate and calculate specific tasks for each month, each day. We shouldn’t use generic phrases like ‘strengthen’ and ‘enhance’ anymore. That way, the entire system can undergo changes,” Dr. Lich advised during the city’s meeting in early April.

Realtique Co., LTD

+84866810689 (WhatsApp/Viber/Zalo/WeChat)