Extend Credit Room To Rescue Businesses

On December 5th, 2022, the State Bank of Vietnam has just issued a decision to adjust credit growth for the whole year to 15.5-16% compared to the previous target of 14%.

Will this decision be able to rescue the economy in a short time?

Life Vest For Businesses

The State Bank of Vietnam increases credit growth by 1.5-2%, accordingly, credit institutions with better liquidity and lower interest rates will enjoy higher credit growth and will focus on priority production and business fields such as agriculture and rural development, export, small and medium enterprises.

Soon, the capital problem will probably be solved

The liquidity of the economy is a problem that causes businesses to be vulnerable in recent times due to bank credit issues. The high loan growth in the first half of this year caused many banks to run out of credit, unable to meet the loaning requirements of businesses.

Therefore, the expansion of the credit room is supported by many experts because it both solves the current capital problem and supports credit capital flows for businesses to promote business plans and supply for the Lunar New Year.

With the above increase, it is estimated that VND 240,000 billion will be “pumped” into the economy in the last month of 2022, equivalent to about 3.8% of the credit room for banks to promptly provide capital for businesses and the economy.

But Is It Too Late?

Although it is considered timely by many experts, the decision to extend the credit room when there is less than a month left before the new year 2023 also makes other experts worry because they think it will be quite difficult to push more than 200,000 billion VND to the market in a short time.

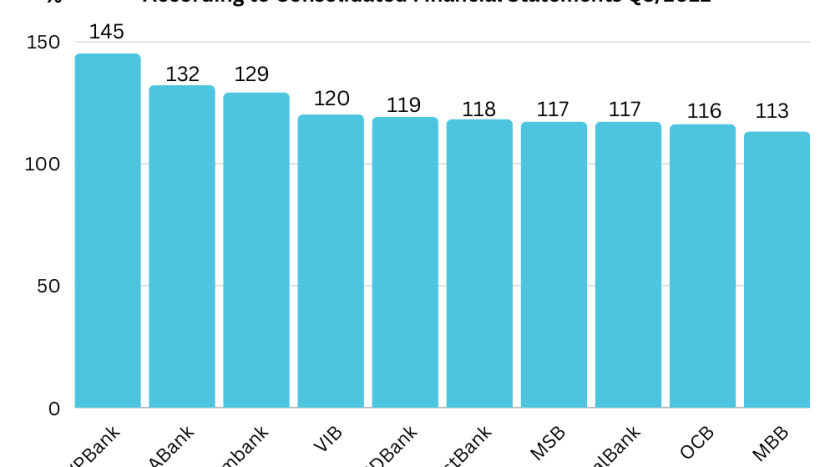

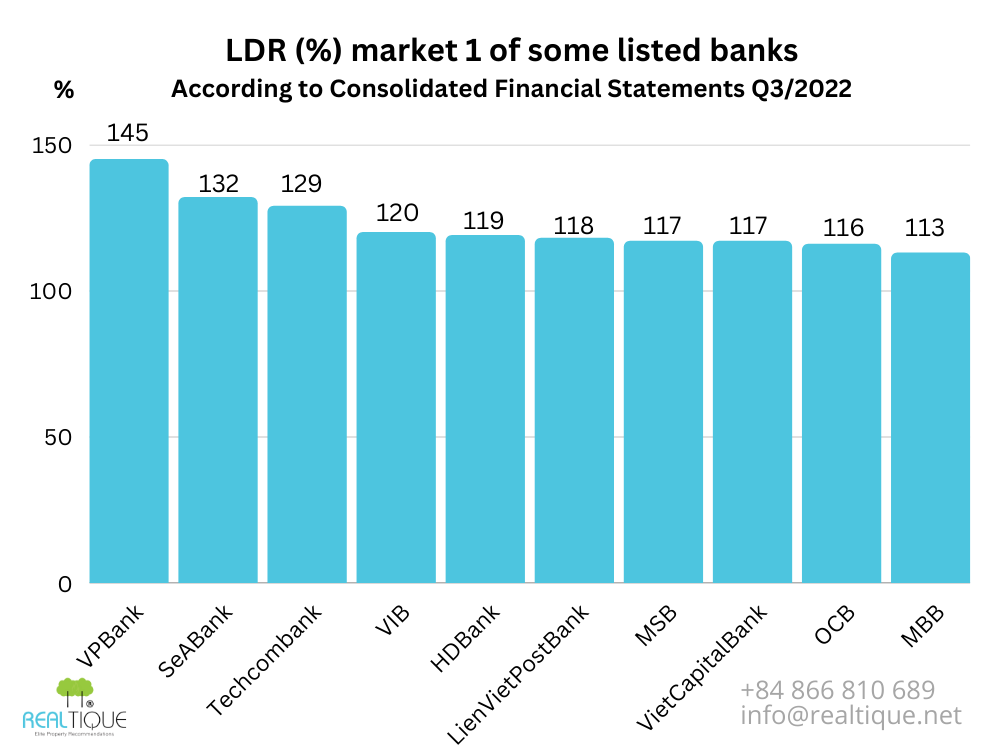

One of the biggest barriers is the LDR – the ratio of outstanding loans to total deposits of many banks has exceeded the allowed limitation of 85%.

Many banks have LDR rates up to more than 100%

This shows that loans increased sharply in the first 9 months of the year, but the mobilization of money disproportionately led to instability in liquidity. The application for a loan is still piling up, but the bank falls into the situation of “having no the money to lend“.

So is it necessary to expand the credit room when many banks have exceeded the allowable limit?

Absolutely necessary and everything is not too late!

In fact, the above situation is not only affected by the inconsistent activities of some banks but also by the world economic situation.

Therefore, the period from the third quarter and earlier is not a favorable time to loosen the credit room because the macro indicators and liquidity of some banks are not guaranteed. Entering December, the economic situation in the world and Vietnam has eased and there are positive signs of recovery, the State Bank may increase credit limits for banks to solve loan problems, increasing capital of promising businesses and projects, paving the way for cash flow and creating a growth potential and at the same time reviewing the operations of banks.

And of course, all monetary activities will be closely monitored by the State Bank of Vietnam in order to assess the situation in time and offer longer-term support solutions.

The loosening of credit room in the current period is a short-term solution. Still, it is expected to bring positive changes in the monetary market, solve problems of lending and liquidity and refresh the real estate market before the new year.

Please contact Realtique for latest update of special projects and events on the market.

Realtique Co., LTD

+84866810689 (WhatsApp/Viber/Zalo/WeChat)